EPC 2025 – A Ticking Timebomb for Older Properties?

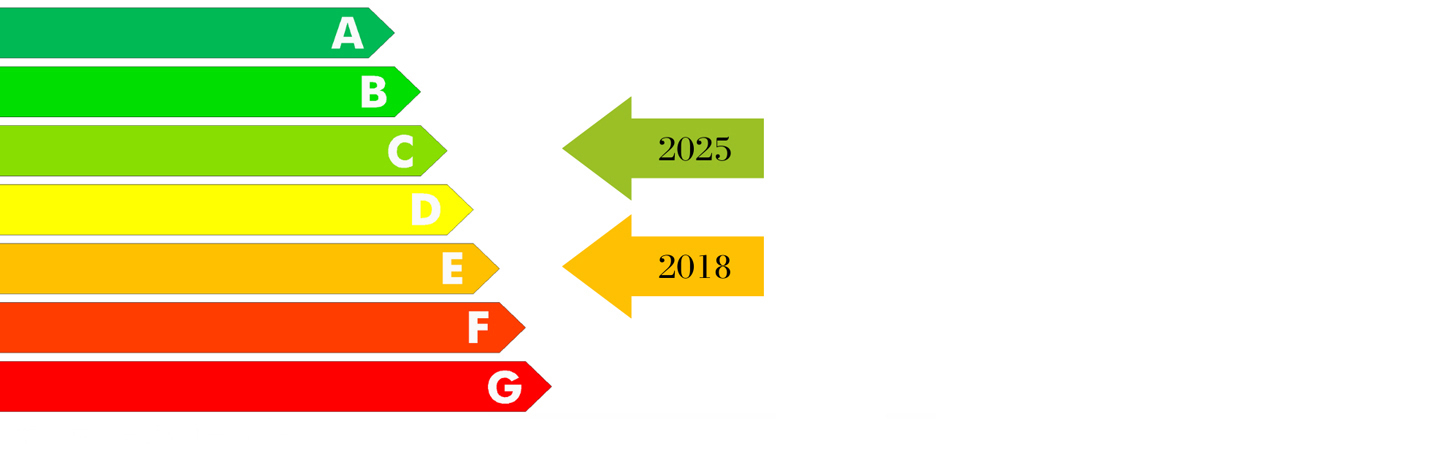

This month Tim Miles-Marsh discusses the government’s proposal for properties to meet an EPC rating of C by 2025. Good news for the environment, but an alarm bell for landlords of older properties?

Climate Change and the Letting Market

If you took a staycation last year, chances are you enjoyed the beauty of Britain’s landscape and architecture. As a nation, we have the oldest housing stock in Europe. Time-weathered stone cottages, thatched roofs, hand-hewn slate – great news for the British tourist industry!

But perhaps not so for the letting industry.

90% of homes in England currently use fossil fuels for heating, cooking and hot water, and meeting environmental standards is a dilemma for landlords of older properties. The government proposes to require all landlords of newly-rented properties to hold an EPC rating of at least C by 2025 and 2028 for existing lets. Following the UK government’s COP26 pledge to be net zero by 2050, many expect this regulatory change to become law.

The Certificates are valid for 10 years.

A good rating can translate into lower energy bills and greener credentials – a plus point for tenants or future buyers.

Isn’t this good news for the environment? What’s the problem?

The rationale for greener energy efficiency is compelling. In 2019, The Department for Business, Energy and Industrial Strategy shared that homes accounted for 15% of UK greenhouse gas emissions, more than agriculture and waste management combined.

However, the problem lies in the financial impact this would have on property owners. Habito estimate that an average of £6,000 is already needed to raise a property from D to C. This doubles to over £12,000 for a large, detached family home.

Would the bill affect lenders as well?

The Minimum Energy Performance of Buildings Bill doesn’t just affect landlords. By December 2030, all mortgage lenders would also need to ensure that the average energy performance level of their domestic portfolios is at least C.

Tim, Relationship Director for Residential Mortgages, comments:

“At the moment, the requirement is for an EPC rating of E or above. If you’re renting out a new-build, a C rating shouldn’t present much of an issue as 75% of new-builds are A or B rated according to the DCLG*. We are already seeing some lenders incentivising their existing customers to upgrade the energy efficiency of their properties. They’re offering further advance products for this purpose (additional lending secured on the property) on preferential rates. This is likely to become widespread.

No one can argue with the rationale behind better energy efficiency – we all want to protect the environment. But fitting insulation and upgrading boilers could be the beginning of fairly sizeable expenses for those with a portfolio of older properties.

Currently, a third of landlords are not confident they’ll meet a C rating in this timescale. We want to help our clients by raising awareness now, and then helping them refinance if they need to”

* Department for Local Communities and Government

I’m a landlord. What should I do?

Shawbrook Bank say 15% of landlords surveyed have no knowledge of this EPC proposal, and 36% have properties built before 1940. A quarter of buy-to-let properties are rated D or below for energy efficiency. The gap between those who are unaware, and those who are prepared, is significant. Nationwide also say a third of landlords don’t know what improvements they would actually need to make to meet the proposed regulations. With some professional advice, bucking this trend is possible”

Tim’s advice:

“Mortgages and home improvements are often the biggest outgoings landlords have. Now is the time for them to review their housing stock EPC ratings and form an action plan early on. It is also important to be aware of the various exemptions that can be registered for.

Failure to do so could either affect the ability to mortgage a property or mean you cannot access the increasing number of green mortgage products that could offer cheaper interest rates”.

How can Ashbridge Partners help me to refinance?

“If you’d like us to investigate mortgage and refinance possibilities for your portfolio in light of this, I’d be delighted to hear from you,” says Tim. “By starting the discussion now, you’re on the front foot. Our due diligence is known to save invaluable time for clients, and with 2025 drawing nearer, time is an important factor we can help you with”

Contact Us:

If you’d like to talk further about mortgage options, please contact:

Tim Miles-Marsh

Relationship Director, Residential Mortgages

01451 830223

07818 848688

tim@ashbridgepartners.co.uk